You’ve probably heard of high-risk car insurance, but what is it really? And do you need it? Here are five things you need to know about high-risk car insurance to help you make the best decision for your needs.

What is high-risk car insurance?

High-risk car insurance is a type of insurance for drivers who are considered to be at a higher risk for accidents or traffic violations. These drivers may have a poor driving record, or they may have been involved in an accident that was their fault. Drivers who are considered high-risk may also have difficulty finding traditional car insurance coverage.

Why is it called high-risk car insurance?

High-risk car insurance is called “high-risk” because the drivers who need it are considered to be at a higher risk for accidents or traffic violations than other drivers. These drivers may have a poor driving record, or they may have been involved in an accident that was their fault. Drivers who are considered high-risk may also have difficulty finding traditional car insurance coverage from a company like Progressive auto insurance.

What makes you a high-risk candidate?

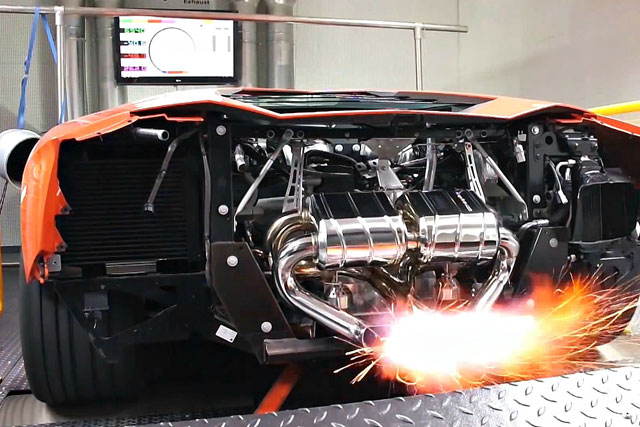

There are a lot of things that can make you considered high risk for car insurance. For example, if you have a lot of speeding tickets, or if you have been in a car accident, you will be considered high risk. If you are a young driver, or if you drive a sports car, you will also be considered high risk. Senior citizens can also be considered high risk.

Basically, if you do anything that makes the insurance company think that you are more likely to get into an accident, then you will be considered high risk. And the higher your risk, the higher your premiums will be.

How much does high-risk car insurance cost?

The cost of high-risk car insurance varies depending on the driver’s individual risk factors. In general, however, high-risk car insurance tends to be more expensive than traditional car insurance. This is because drivers who are considered high-risk are more likely to file a claim than other drivers.

What are the benefits of high-risk car insurance?

The main benefit of high-risk car insurance is that it provides coverage for drivers who would otherwise be unable to find traditional car insurance coverage. This type of insurance can be a lifeline for drivers who have a poor driving record or who have been involved in an at-fault accident.

What are the drawbacks of high-risk car insurance?

The biggest drawback of high-risk car insurance is the cost. This type of insurance can be very expensive, and it may not provide the same level of coverage as traditional car insurance. Additionally, some insurers may require drivers to purchase high-risk car insurance for several years after they become eligible for traditional coverage.

Alternatives to High-Risk Car Insurance

If you’re a high-risk driver, you know that car insurance can be expensive. But did you know that there are alternatives to high-risk car insurance? Here are three of them.

1. Join a driving club

Joining a driving club can help you save money on your car insurance. How? Driving clubs typically offer their members discounts on car insurance. And, if you’re a member of a driving club, you’re more likely to be a safer driver—which means you’ll be less of a risk to insurers.

2. Take a defensive driving course

Taking a defensive driving course shows insurers that you’re serious about being a safe driver. And, as a result, you may be eligible for discounts on your car insurance premiums.

3. Shop around

Don’t just accept the first quote you get from an insurer. Instead, shop around and compare rates from different insurers. You may be surprised at how much money you can save just by doing a little bit of research.

4. Consider a telematics insurance program

A telematics insurance program is a type of insurance that uses technology to track your driving habits. And, if you’re a safe driver, you could qualify for discounts on your car insurance premiums.

5. Install safety gadgets in your car

Installing safety gadgets in your car—such as a dash cam or an immobilizer—can help you save money on your car insurance. And, if you have a newer car, it may already come with some of these features.

High-risk car insurance is a type of insurance for drivers who are considered to be a higher risk for accidents or traffic violations. These drivers may have a poor driving record, or they may have been involved in an accident that was their fault. Drivers who are considered high-risk may also have difficulty finding traditional car insurance coverage. High-risk car insurers tend to charge higher rates because these customers pose a greater statistical risk of filing claims. Although purchasing this type of policy can be expensive, it may be the only option available for some drivers.